Summary of the ISO 20022 Standard

Introduction to ISO 20022: ISO 20022 is an internationally recognized standard for financial messaging that serves as a “common language” for global financial transactions. It was developed to address the limitations of legacy systems by offering a unified framework for data exchange. The standard supports interoperability, improves data quality, and facilitates automation across payments, securities, foreign exchange, trade, and cards.

It provides a structured methodology that includes:

- Business Process Models: Define financial processes and data requirements.

- Logical Models: Ensure consistency and independence from syntax.

- Syntax Options: Enable flexibility with XML and JSON as widely used formats.

ISO 20022 is not just a messaging standard but a methodology to describe business activities in a modular and reusable manner. Its global adoption is transforming how financial institutions communicate.

Core Components:

- Business Model Layer:

- This layer outlines key financial processes, roles, and required business information.

- For example, in a credit transfer, it identifies roles like debtor (payer), creditor (payee), and their respective agents (banks).

- Logical Model Layer:

- This layer creates abstract, syntax-independent representations of messages.

- Logical models define all data components needed for specific business activities in a hierarchical structure.

- Syntax Layer:

- The syntax is the physical format used for data representation.

- ISO 20022 primarily uses XML, a widely adopted format for encoding structured data. JSON, a lightweight format popular in APIs, is increasingly used.

- Central Repository:

- A dictionary of business components ensures standardization and reusability across financial transactions.

- Examples include commonly reused elements like debtor agent or creditor address.

Benefits of ISO 20022:

- Improved Data Quality and Richness:

- Messages carry more detailed and structured data compared to legacy formats.

- Supports enhanced remittance information, reducing errors and enabling detailed insights for regulatory and business purposes.

- Increased Automation:

- By standardizing formats and semantics, ISO 20022 promotes straight-through processing (STP), reducing manual intervention and operational costs.

- Interoperability Across Standards:

- The modular design enables mapping between ISO 20022 and legacy systems like SWIFT MT, ACH, and FIX. This supports coexistence and gradual migration.

- Regulatory and Compliance Benefits:

- Facilitates compliance with international regulations by standardizing the structure and content of financial data.

- Supports transparency and auditability for anti-money laundering (AML) and other regulatory needs.

- Future-Proofing:

- Designed to accommodate evolving business needs, including complex financial instruments and regulatory requirements.

- Flexible and extensible, allowing for new message types and updates without disrupting existing processes.

Applications and Use Cases:

- Payments:

- End-to-end messaging for customer-to-bank, interbank clearing, settlement, and reporting.

- Widely used for SEPA (Single Euro Payments Area) payments in Europe and global cross-border transactions.

- Securities:

- Messaging for trade instructions, clearing, settlement, and corporate actions.

- Adopted by market infrastructures like TARGET2-Securities (T2S) and the US Depository Trust and Clearing Corporation (DTCC).

- Trade Services:

- Standardized formats for trade finance processes, including e-invoices, guarantees, and factoring.

- Foreign Exchange (FX):

- Post-trade messaging for FX markets, enhancing transparency and efficiency.

- Cards:

- ISO 20022 messages support ATM management, card transactions, and acquirer-to-issuer communications.

Implementation and Global Adoption: ISO 20022 is gaining traction worldwide, driven by its ability to replace fragmented legacy systems with a unified framework. Key milestones include:

- European Payments: SEPA adopted ISO 20022 as its standard for euro transactions.

- Cross-Border Payments: SWIFT’s migration from MT messages to ISO 20022 by 2025 will affect over 11,000 institutions globally.

- Regulatory Reporting: Authorities like the European Central Bank and US Securities and Exchange Commission are mandating ISO 20022 for reporting purposes.

Implementation Considerations:

- For Small Players:

- Adoption can be gradual, using middleware to map legacy systems to ISO 20022 formats.

- For Larger Institutions:

- Enterprise Application Integration (EAI) tools can help manage complex legacy systems, enabling smooth migration to ISO 20022.

- For New Entrants:

- ISO 20022 provides ready-to-use data definitions, reducing the complexity of setting up internal structures.

Challenges and Coexistence: While ISO 20022 offers significant advantages, the coexistence of legacy standards remains a reality. Migration costs, the complexity of large-scale adoption, and regional variations present challenges. However, the standard’s interoperability ensures it can work alongside existing systems until full migration is achieved.

Future Prospects: ISO 20022 is poised to become the universal language of financial messaging. Its ability to unify global financial processes, support regulatory compliance, and foster innovation makes it a cornerstone of modern financial infrastructure.

For more details, visit the ISO 20022 Official Site.

List of Resources with Hyperlinks

- ISO 20022 Official Site

- SWIFT MyStandards

- ISO 20022 Supporting Documentation

- NACHA ISO 20022 Resource Center

- Federal Reserve System’s ISO 20022 Resource Center

- ACH-ISO 20022 Mapping Guide

- ISO 20022 Payment Messages Specifications

- Case Study: Merck and ISO 20022

- ISO 20022 Adoption Considerations for U.S. Wire Transfer Systems

- Understanding the ISO 20022 Stand-alone Remittance Messages

- ISO 20022 Business Case Assessment

- Payments and ISO 20022 in the US Market

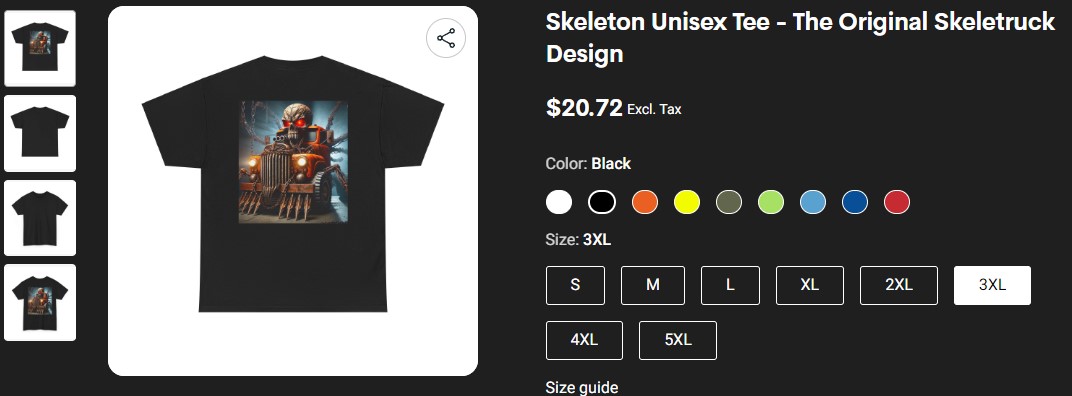

MERCH

MERCH

Leave a Reply